Vision

We seek insight and understanding of our clients’ businesses and use our expertise to find innovative solutions for them.

Respect

We support and respect each other and help each other to achieve our full potential.

Integrity

Our ethos is based on being open and straightforward. We only give advice we believe in.

Accounting , Auditting & Tax Services

Our comprehensive range of accounting services will help you comply with all the relevant reporting regulations. As well as full statutory year-end financial statements, we can provide monthly or quarterly management accounts and assistance with the preparation of budgets and projections.

More Details

Our Services

Auditors and Business Consultants in the KSA. What sets us apart is the way we invest in our relationships. We develop a deep understanding of your business and personal circumstances. This allows us to advise you more effectively.

Accounting

Our comprehensive range of accounting services will help you comply with all the relevant reporting regulations. As well as full statutory year-end financial statements, we can provide monthly or quarterly management accounts and assistance with the preparation of budgets and projections.

Audit & Assurance

Our audit specialists can provide an efficient and independent report to your shareholders about the company’s profitability and state of affairs. A good audit should also provide insight into areas to focus on for enhancing the performance of your business. We provide a comprehensive range of dedicated corporate finance services.

VAT in KSA & GCC

Value Added Tax (or VAT) is an indirect tax imposed on all goods and services that are bought and sold by businesses, with a few exceptions. In June 2016, the GCC countries agreed to impose VAT across the GCC region. In February 2017 (Jumada Al-Awwal 1438), Saudi Arabia ratified the GCC VAT framework and committed to impose VAT with effect from January 1, 2018 (Rabi Al-Thani 14, 1439). VAT will be introduced at a standard rate of 5%.

VAT

Laws & Regulations

Value Added Tax (or VAT) is an indirect tax imposed on all goods and services that are bought and sold by businesses, with a few exceptions. VAT is applied in more than 160 countries around the world as a reliable source of revenue for state budgets.

VAT Law:

The VAT Law defines the introduction of VAT outlined in the Unified Agreement for VAT of the Cooperation Council for the Arab States of the Gulf, it will be applied on 1st January 2018 (H1439/4/14).

The VAT Law was officially approved and published on H1438/11/4.

VAT Implementing Regulations:

The VAT Implementing Regulations expand on the areas covered within the KSA VAT Law, detailing rules for implementation and giving taxpayers sufficient information to complete their VAT compliance requirements. The Implementing Regulations cover:

We Provide Accouting , Auditing & VAT services

Our Team

Syed Asif Zaman – ACA(Eng.& Wales), ACA (Pak), FPFA, AAIA, CISA, MBA, B.Sc.

CEO

Mujeeb Rao – FCA

Managing Partner

Contact us

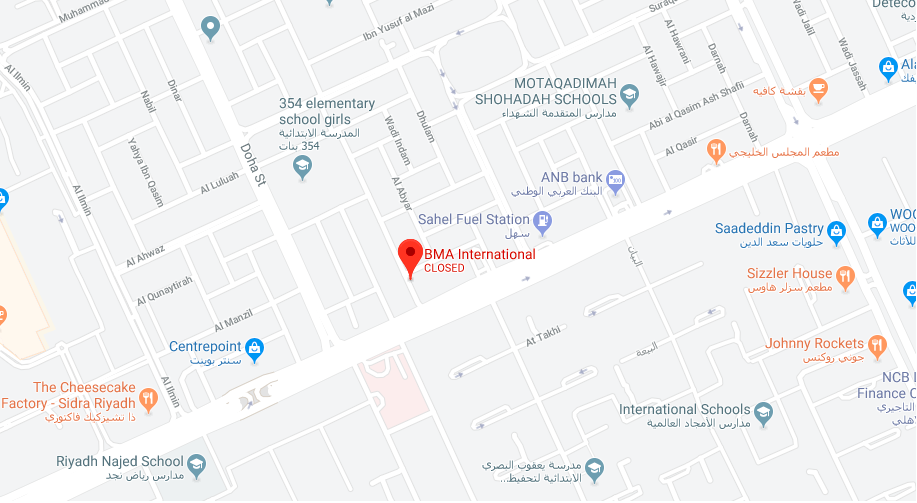

Office No: 9, Building No: 24, Al Mashreq Street, King Abdul Aziz Road, Al Sulaimaniyah, Riyadh, Saudi Arabia